How to Trade Crypto in Coinmetro

Getting Started with the CoinMetro Exchange Platform

The CoinMetro Exchange Platform offers more precision and more control over trading than the Dashboard Swap Widget. If you would like to start trading with more precision than just buying and selling, or if you’d just like a quick breakdown of CoinMetro’s Exchange platform, you’ve come to the right place!

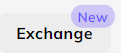

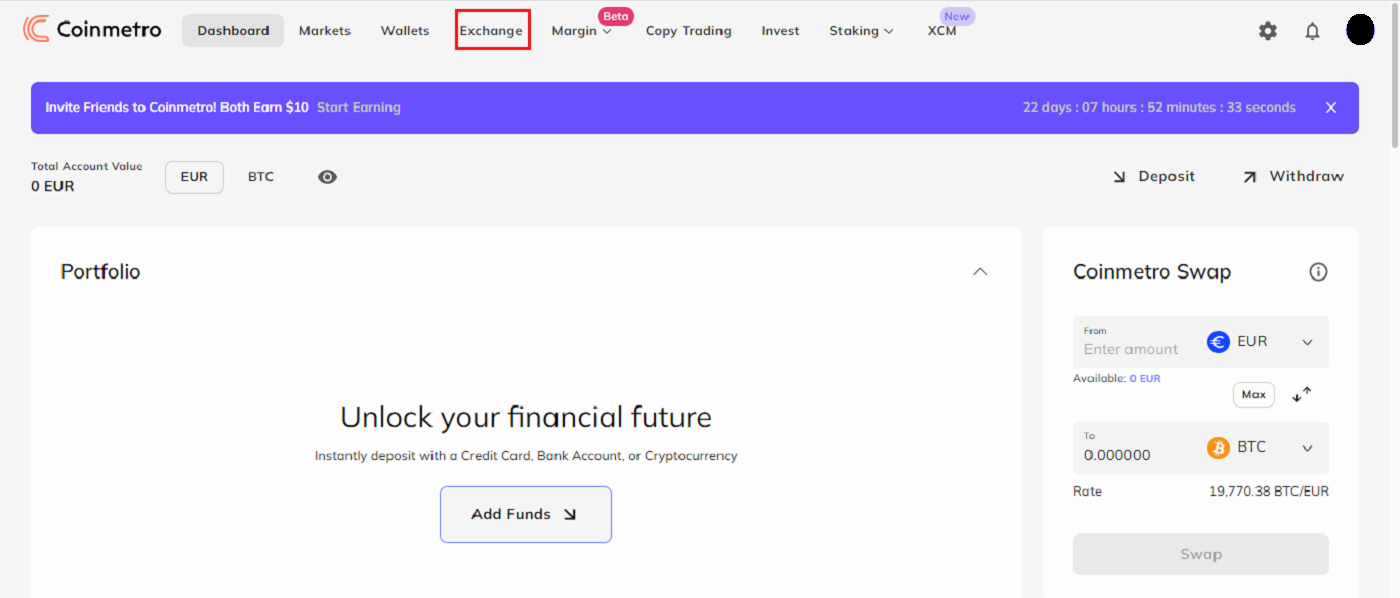

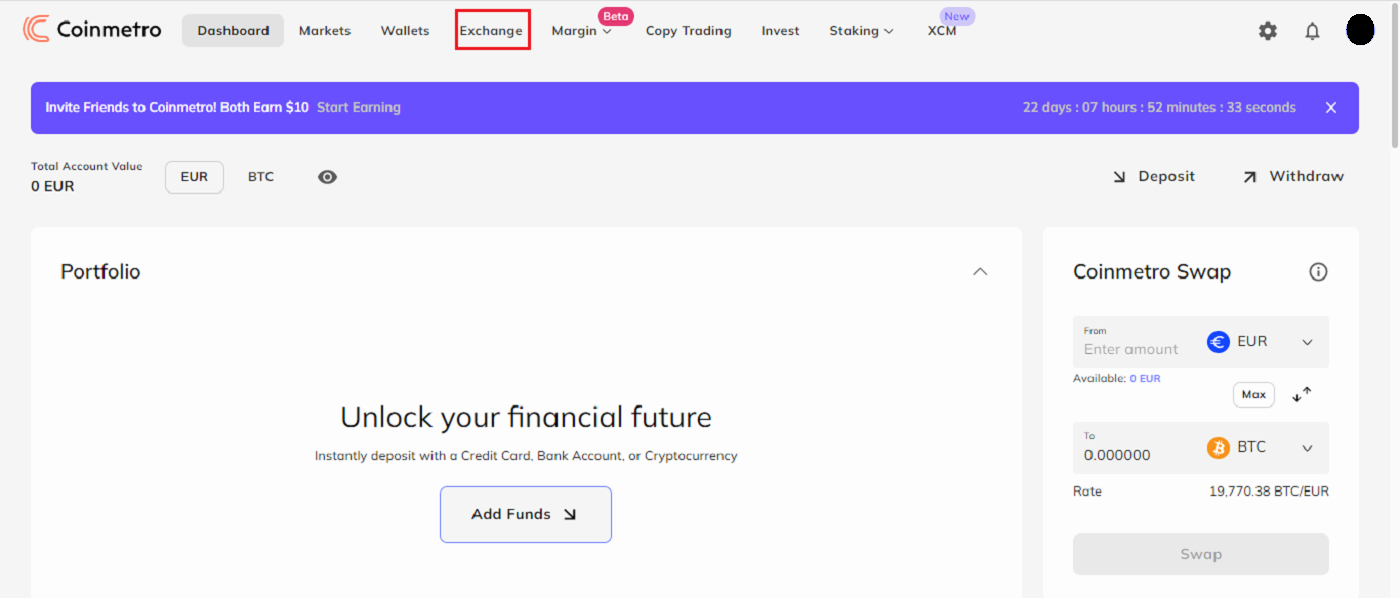

The CoinMetro Exchange Platform can be accessed by selecting the Exchange tab from either your CoinMetro Dashboard or the Markets page.

How to find your active limit order on the CoinMetro Exchange Platform.

On Desktop

Click on the ’Exchange’ tab at the top of the screen.

On the Coinmetro Mobile App

Click on ’More’ in the bottom right-hand corner, then ’Exchange’ from the side menu.

Why use the Exchange Platform?

When using the Dashboard Swap Widget, you can very easily buy or sell cryptocurrency at a fixed price, making it perfect for quick trades at the best available price. The Exchange Platform instead offers much more precise trading, placing orders at various price points to be traded in the future, and more:

- Buy or sell at the best available price, just like Dashboard Swap Widget (Market Order),

- View price charts with built-in trading indicators,

- View order books for all orders for trading pairs, showing at what prices other traders are looking to buy or sell,

- Place Limit Orders, allowing you to place an order to be filled at a specific price,

- Place Stop Orders to limit losses in case the market moves against you,

- See an easy overview of your pending and previous orders.

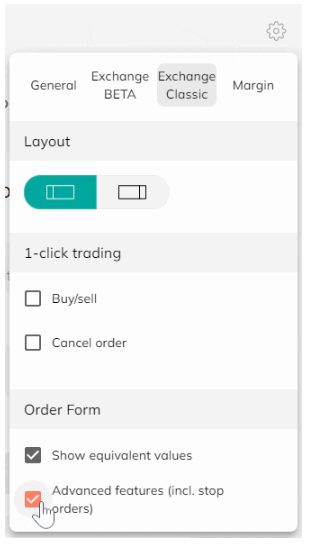

Please note that to enable stop orders and finer order control such as allowing partial fills, this must be enabled from the settings menu, available via the cogwheel.

Price Warnings

Following our recent platform update, our effort to improve your trading experience is continuing with the introduction of a new Price Warning feature. The Slippage Warning Dialog is there to show you in real-time if any of your orders could lose more than 3% due to slippage. This is an important component of your trading arsenal, as it will warn you immediately before confirming orders. Use this to your advantage, so you can be aware, act fast and stay on top of the markets.

The Price Warning Dialog shows up if the user submits an order which could lose more than 3% due to slippage. The mechanism works like this:

- No warning is shown when slippage is under 3.00%

- It shows a green warning from 3.00% to 4.99%

- It shows an orange warning from 5.00% to 9.99%

- It shows a red warning from 10.00%+

- The calculation takes the size of the order into account and adjusts the slippage warning percentage accordingly

- It will appear when placing a new market/limit order or editing an open order

- It will appear on both the Exchange and Margin platforms.

- Take spread into account (for now)

- It will not appear when doubling or closing a % of Active Positions on Margin (for now).

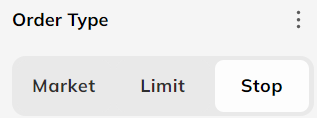

Exchange Platform Order Types

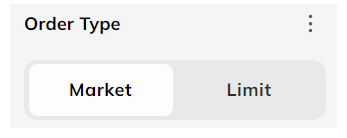

When placing an order on the Coinmetro Exchange Platform, you may have noticed that you will have the option to place market orders, limit orders, and for advanced traders, stop orders.

Market Orders

Market orders are the most basic buy and sell trades, where a user places a trade order which then will be filled at the price this is currently going for in the book. When placing a market order, you are opting for whatever price the asset is currently going for, so the trade will be filled rather quickly. For example, if placing a market sell order, this means that the asset will sell for whatever a buyer is bidding for in the books. Please be mindful that the price displayed before executing the order may not be the price that your asset sells for.

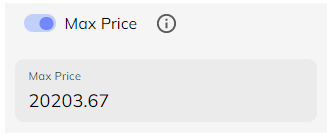

Coinmetro offers the option to apply price protection on your market order when checking the ’max/min’ slider. This will ensure that your market order is not filled below or above the specified price. If you would like more fine-grained control of your market order you can use this setting. Please note, the possibility to use this feature is dependent on liquidity.

A limit order is an order instruction to buy or sell an asset at a specified or better price.

Typically, each pair in exchange has its own order book. An order book contains the limited orders that other users have placed in the book.

When a limit order is placed, it will remain in the order book until it is matched with another order. Using limit orders, a trader can specify the price they would like to buy or sell the asset at. Please note that there is no guarantee that other traders will match you at your price.

Why are Limit Orders advantageous?

A limit order when buying an asset ensures the user that the buy price will not exceed any higher than the amount selected. When placing a sell limit order, this of course would mean that the sale price would not execute any lower than the amount selected.

This gives users more control over their orders placed, however, please be mindful that limit orders are two-sided, meaning that another user would need to buy or sell at your specified price in order for it to fill.

Stop Orders

A stop order, or ’stop-loss’ order, is an order to buy or sell an asset once the price of the asset reaches a specified price, known as the stop price. When the stop price is reached, a stop order becomes a market order. A buy stop order is entered at a stop price above the current market price.

Stop orders can be used to manage markets moving against you. For example, if you were to set a stop order to sell BTC at a minimum price of 40,469, it will automatically be sold at market price once the price of BTC reaches 40,469.

It is possible to combine limit and stop orders, to automatically place a limit order when the stop price is reached. On Coinmetro’s Margin Platform, you can set a stop price for your positions, which will automatically close your positions at market price, if the latest traded price reaches the stop price.

How to Buy Crypto on Coinmetro

After signing in Coinmetro:1. Visit the Coinmetro homepage, Click on the Exchange tab to purchase or sell crypto.

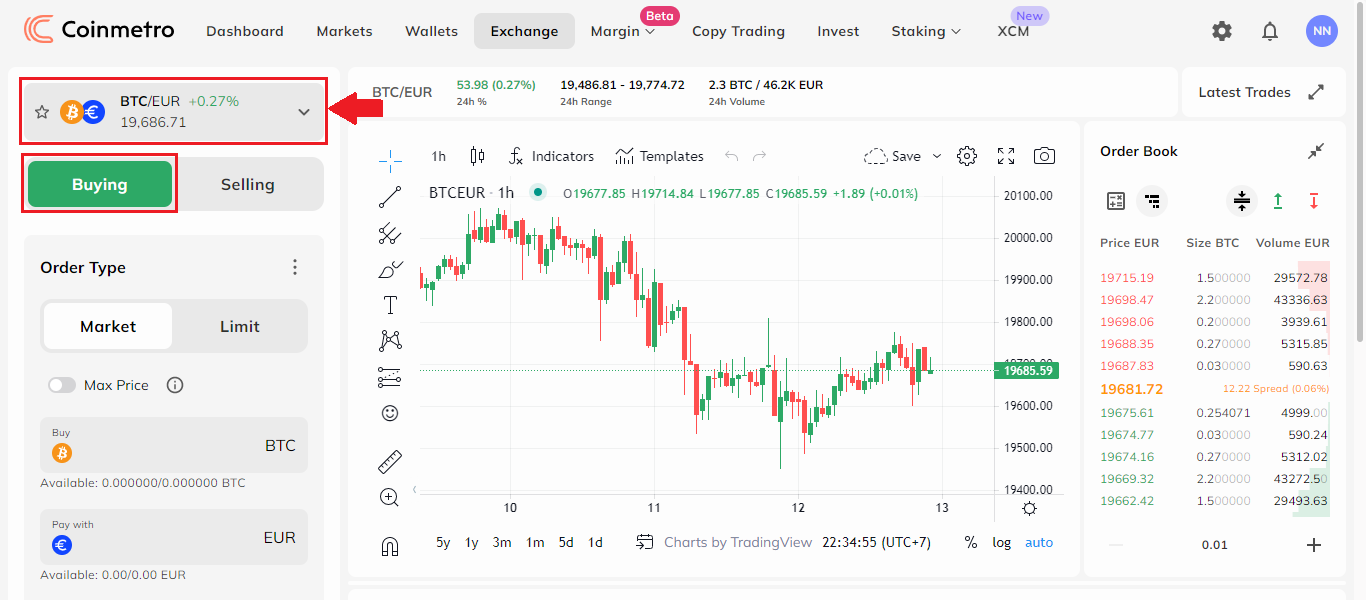

2. Then choose the crypto to exchange. Here, we use BTC/EUR as an example.

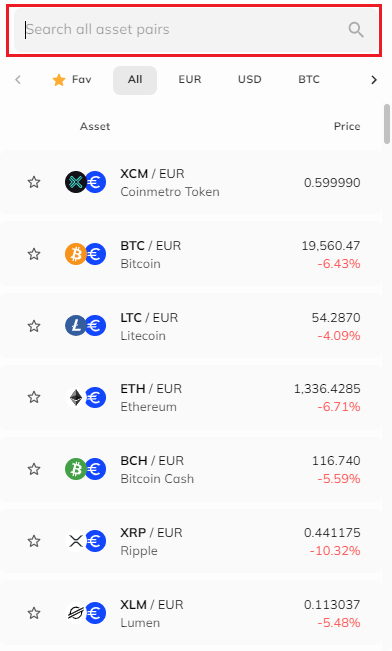

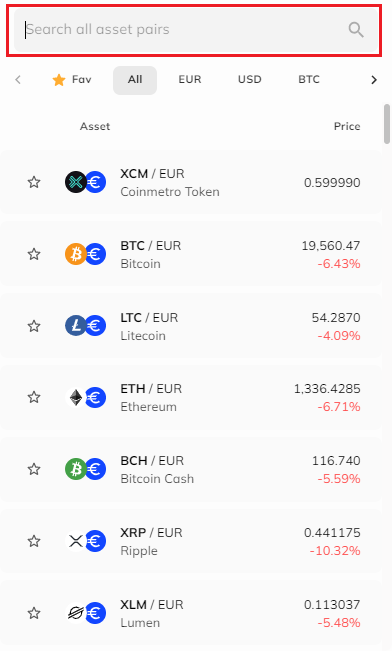

3. To search and look for the crypto you would need to exchange by simply typing in the crypto acronym in [Search all asset pairs] area.

Market Trading

After choosing the crypto type you can purchase the crypto by clicking on Buying.For buying at the current Market Price:

(1) Click on the Market tab.

(2) Type how much to buy in BTC area

(3) Or type in how much EUR (currency) area

(4) Click on Buy BTC @ Market to submit the decision.

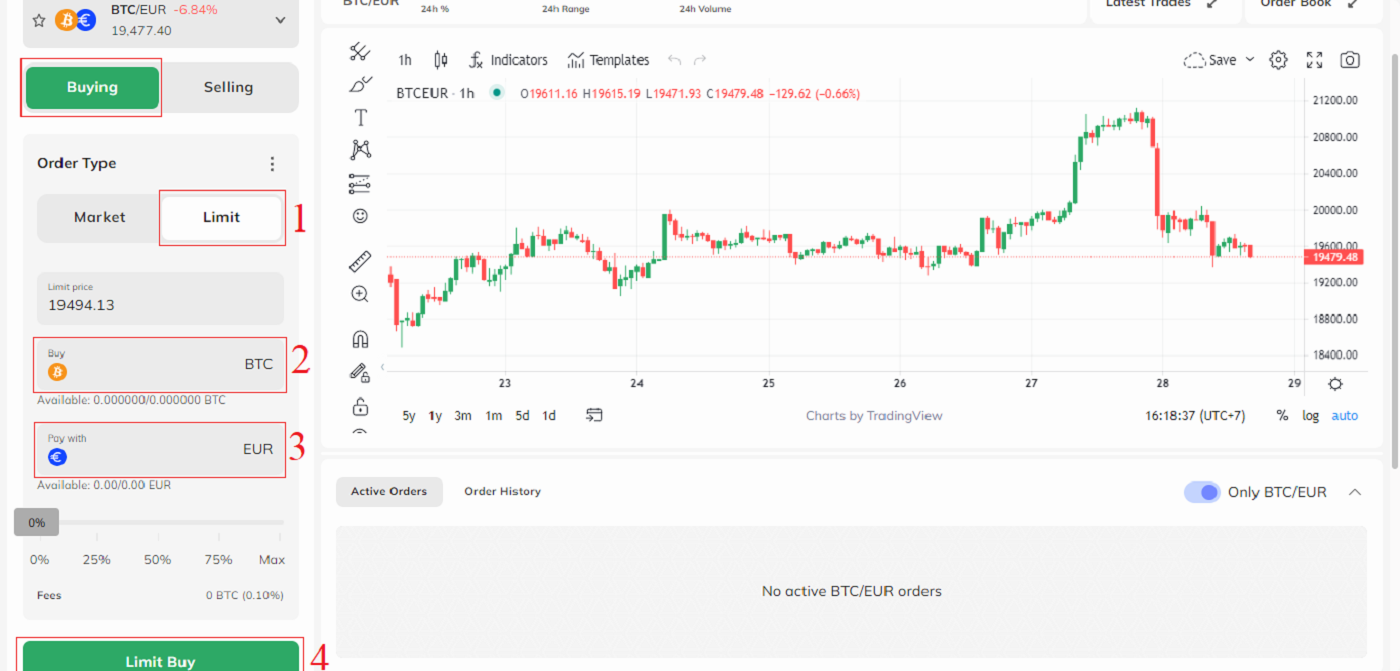

Limit Trading

For Limit Buying, follow these steps: (1) Click on the Market tab.

(2) In BTC area to type how much crypto you would like to buy,

(3) Or type in how much in EUR (currency) area to buy.

(4) Click on Limit Buy to submit the decision.

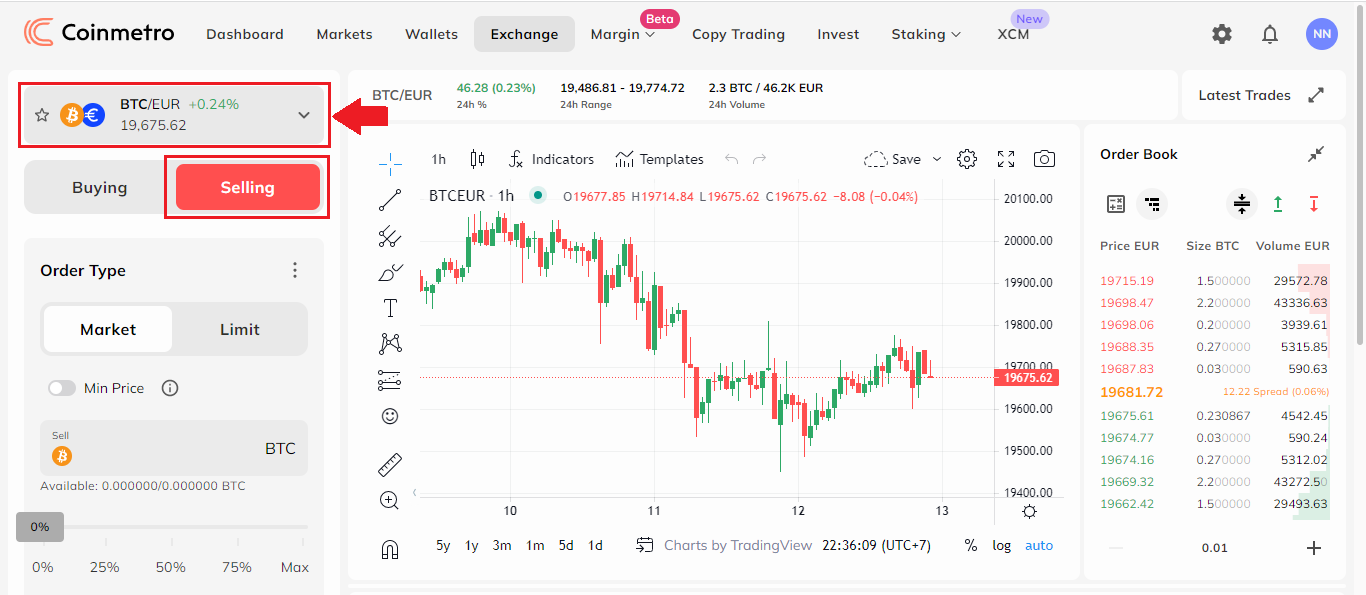

How to Sell Crypto on Coinmetro

After signing in Coinmetro:1. Visit the Coinmetro homepage, Click on the Exchange tab to purchase or sell crypto.

2. Then choose the crypto to exchange. Here, we use BTC/EUR as an example.

3. To search and look for the crypto you would need to exchange by simply typing in the crypto acronym in [Search all asset pairs] area.

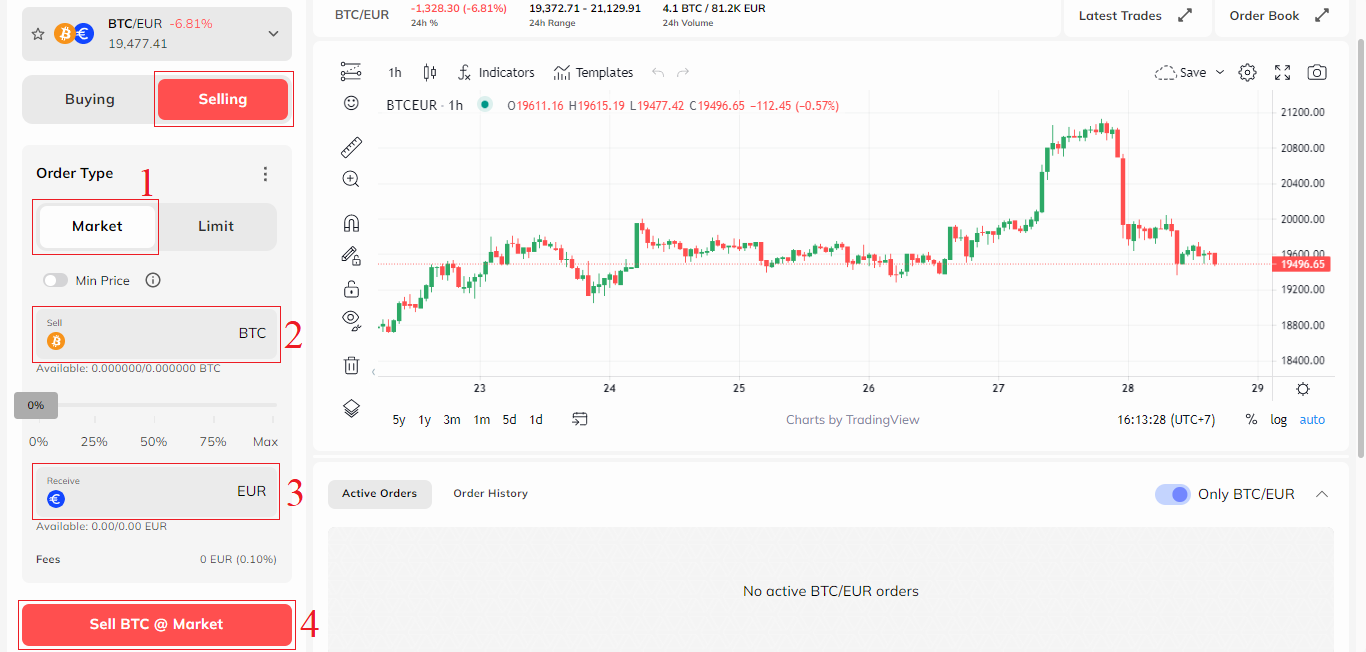

Market Trading

For Selling at the current Market Price:(1) click on the Market tab.

(2) Type how much to sell in BTC area

(3) Or type in how much EUR (currency) area

(4) click on Sell BTC @ Market to submit the decision

Limit Trading

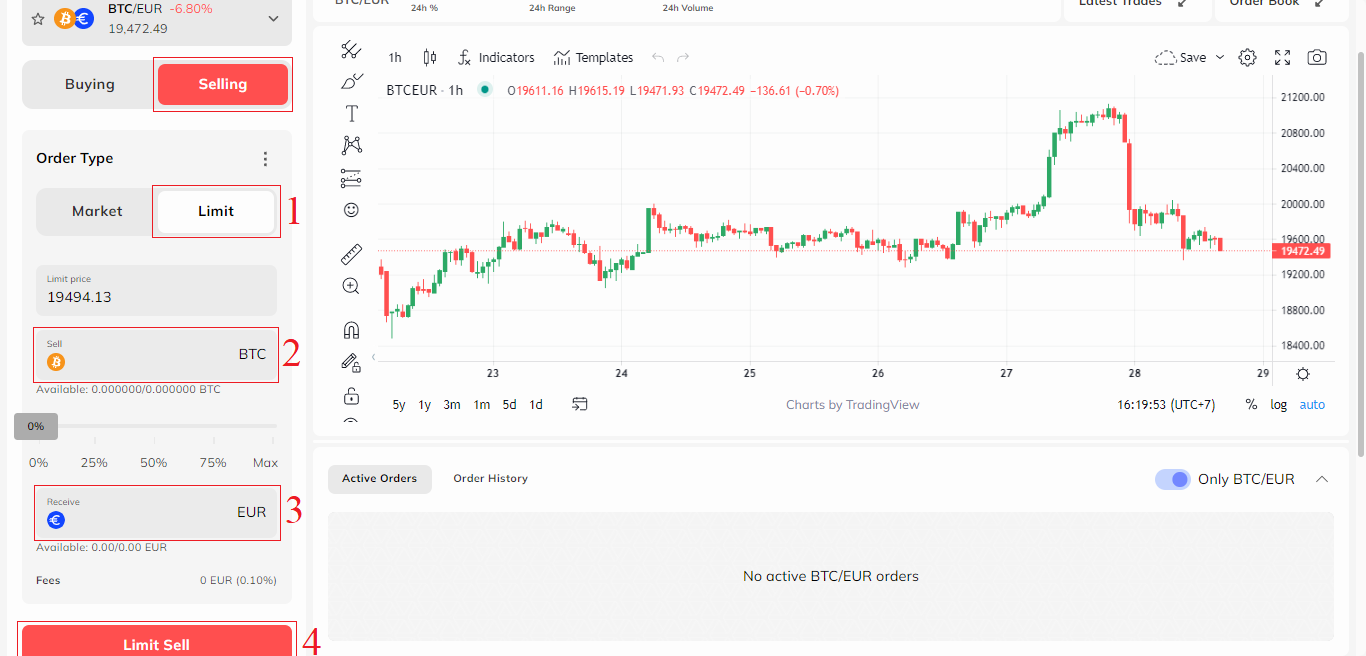

For Limit Selling, follow these steps: (1) Click on the Market tab.

(2) In BTC area to type how much crypto you would like to Sell,

(3) Or type in how much in EUR (currency) area to Sell.

(4) Click on Limit Sell to submit the decision.

How to Place a Stop Order

A Stop Order (also referred to as a stop-loss), is an order placed to buy or sell an asset once the price of the asset reaches a specified price (known as the stop price). When the stop price is reached, a stop order becomes a market order. A buy stop order is entered at a stop price above the current market price.

Stop orders can be placed both on the Coinmetro Exchange Platform and the Margin Platform.

In short, a stop order will trigger an order when an asset reaches a specific price. On the Coinmetro Exchange platform, you can use a stop order to sell an asset if it drops below a certain price, or buy an asset if it moves above a certain price.

When are Stop Orders useful?

An example of when a stop order could be useful is when chart analysis suggests a strong support level at a certain price. By placing a sell order at a price point below the support level, you can protect yourself against further loss, in case the support would break.

How to Enable Stop Orders

To enable the stop order option in the Exchange platform, advanced features must be enabled in the Settings menu, accessible via the cogwheel in the upper right section of your screen.

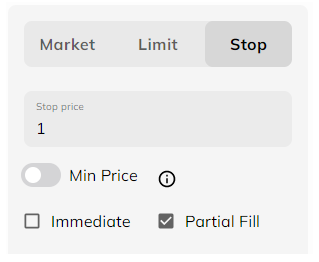

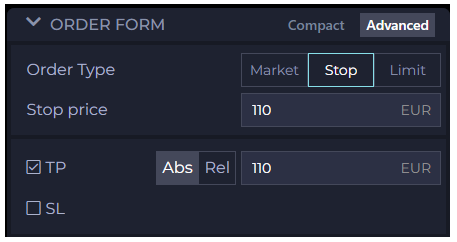

The Order Form for Stop Orders

To explain the order form for a stop order, the first field to look at is the Stop Price. In the example below, the stop price has been set to 1 EUR for XCM. This means that once XCM reaches the price of 1EUR, either a market or limit order will be triggered.

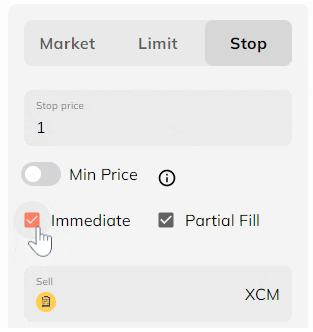

How to Execute a Market Stop Order

The first way you can utilize a stop order is to execute a market order when your stop price is reached. To do this, all you need to do is input the Stop Price, enable Immediate Order and place your order.

With the Partial Fill box checked, your order will be executed as Immediate-or-Cancel. If any portion of your order isn’t filled, it will be cancelled.

With the Partial Fill box unchecked, your order will be executed as a Fill-or-Kill market order. If your whole order can’t be filled, it will be cancelled.

Please note that market orders will generally be filled entirely at a fair market price on most of our available pairs. However, we advise you to always combine your Stop Price with a Max/Min (depends if you are buying or selling) price, to protect you in case there are no orders available near your stop price, which otherwise might cause your market order to be executed at a loss.

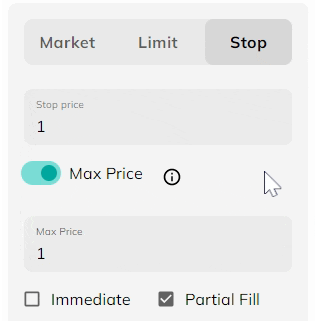

How to Execute a Limit Stop Order

By setting a Max Price (when buying) or Min Price (when selling) together with your stop price, your stop order will execute a limit order once your stop price is reached.

Without Immediate Order selected, it will place a limit order into the book at the specified price, which will remain until filled or cancelled.

With a limit price set, the Immediate Order option should not be ticked. If this option is selected, it will execute as a market order up to your limit price. The Stop Price is at what price point your order will be executed.

How to Set a Stop Loss or Take Profit

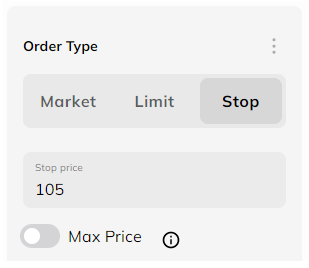

What is a Stop Order?

Stop orders are used to enter a position when the price breaks above or below a certain level (the Stop price). Stop orders are available on the Exchange Platform (with Advanced features enabled) and the Margin Platform.

For example, if the price for QNT is currently 104 and you want to buy as soon as the price gets to 105, you can place a Stop Buy order with a stop price of 105.

Similarly, if you placed a Stop Sell order with a stop price of 100, you would sell once the price drops to 100. These are typically used to enter "breakout" trades when the price breaks through a key support or resistance level.

What is Take Profit?

Take Profit (TP) can be set up by simply using a Limit Order at the price you wish to sell your asset to gain a profit.

For example, if I bought QNT at 100 EUR and would like to sell it once the price reaches 110 EUR, I would set a Limit Order to sell my QNT at the 1110 EUR mark. This offers an offhand approach to setting a Stop Loss because it is always good to have a figure in mind on when you would like to exit if the price starts dropping. The order will be visible in the order books from the start and other traders will see that you are buying QNT at the 110 EUR mark.

The Take Profit option is currently available on the Coinmetro Margin Platform; however, this is not yet available on the new Margin Beta but more advanced features are due to be added in the near future! In the meantime, if you wish to set up a Take Profit (TP), you can do so by editing your order or position, or by using the Classic Margin Platform.

Summary

Stop Loss (SL) - Set at a price at which the order automatically closes, when the price of the investment reaches a specified lower price.

Take Profit (TP) - Set at a price at which the order automatically closes, when the price of the investment reaches a specified upper price.

In Margin Trading a new limit or stop order will always open a new position, even if you have an existing open position for the same pair. It’s possible to be both long and short in the same pair at the same time in margin trading.

In margin trading the take profit and stop loss are specified in the opening order or subsequently added to the open position.

Frequently Asked Questions (FAQ)

Where can I see my active orders?

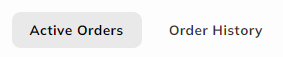

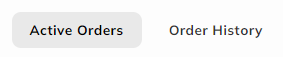

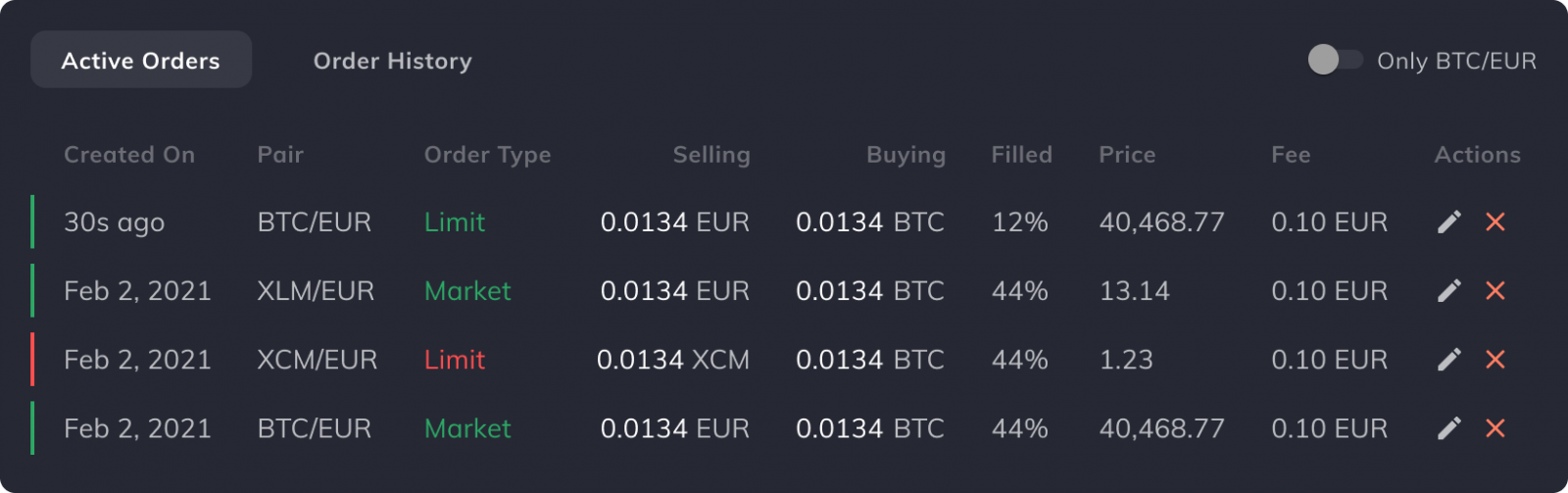

You can easily view your active orders on the Exchange Platform with just the click of a button!

On Desktop

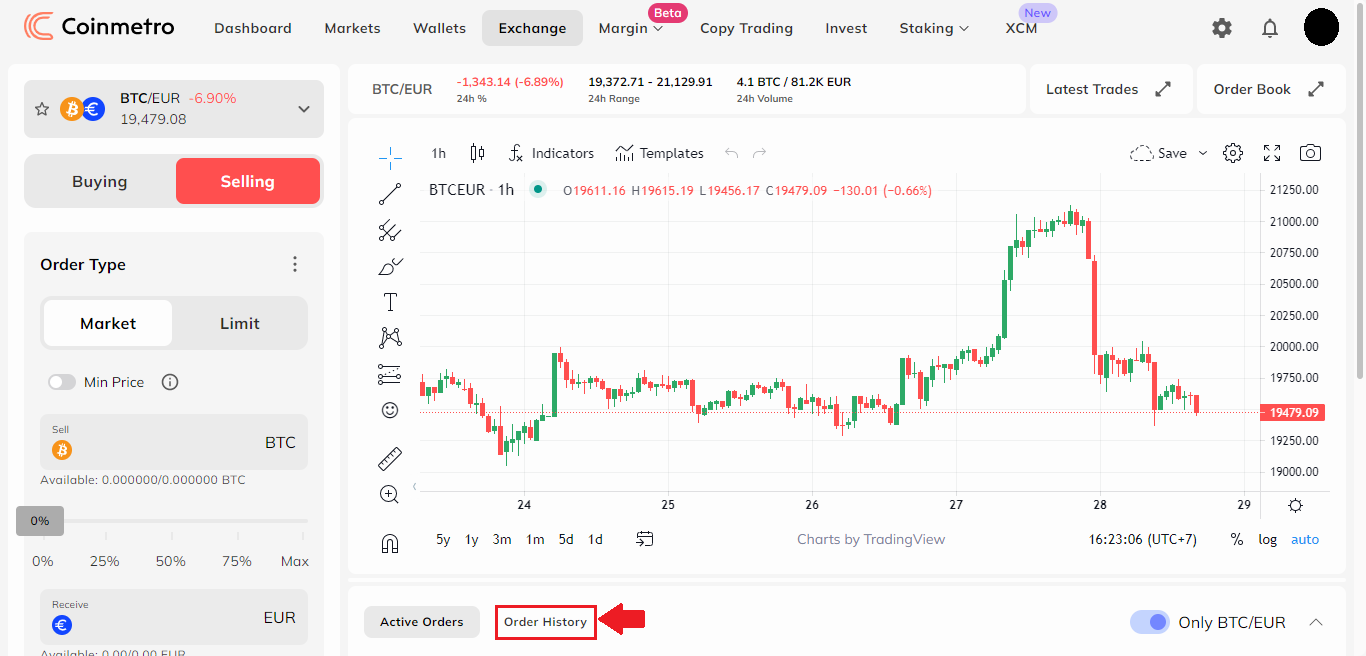

Firstly, from your Dashboard, head to the Exchange Platform by clicking the ’Exchange’ tab at the top of the page.

Then, scroll down and click on the ’Active Orders’ tab to view your active limit orders.

On the Coinmetro Mobile app

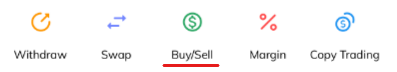

From your Dashboard, you can enter the Exchange Platform by either tapping on the ’Buy/Sell’ icon below your account balance, or tapping on the ’More’ icon in the bottom right-hand corner, then clicking on ’Exchange’.

Then, scroll down and click on the ’Active Orders’ tab to view your active limit orders.

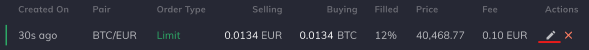

How to Edit an Active Limit Order?

Limit Orders can be cancelled easily in just a few clicks!

Firstly, you will need to head to the Coinmetro Exchange Platform.

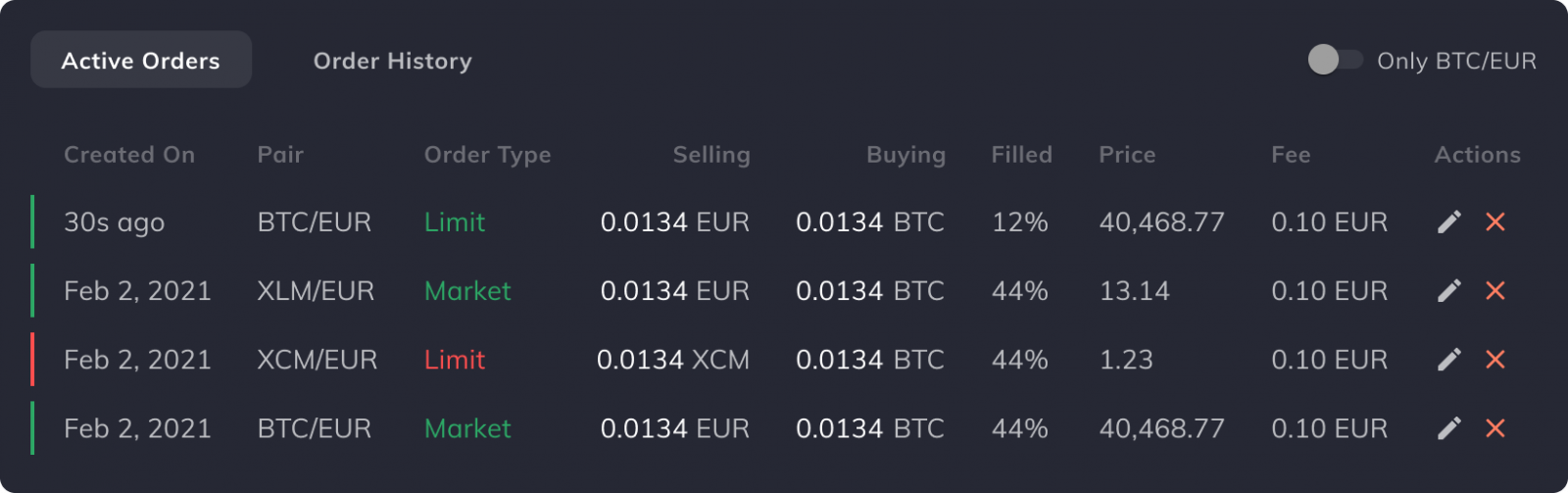

Then, at the bottom of the page underneath the price chart, you will see the Active Orders tab. Here you can see all of your current active limit orders.

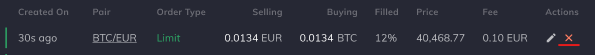

Then, find the order you wish to edit and select the pencil icon as highlighted in the image below.

Here, you will be able to view your order and make any necessary adjustments including editing the limit price, and the order size, and you can even add a comment (optional)!

Now, all you need to do is select Confirm Adjustment and the changes will be applied to your order. Congratulations, you have successfully edited your limit order!

How to Cancel an Active Limit Order?

Active Limit Orders on the Coinmetro Exchange Platform can easily be cancelled in just a few clicks!

Firstly, you will need to head to the Coinmetro Exchange Platform.

At the bottom of the page underneath the price chart, you will see the Active Orders tab. Here you can see all of your current active limit orders.

Then, find the order you wish to cancel and select the red cross button as highlighted in the image below.

Finally, confirm the cancellation of your order on the cancel dialogue box.

Please note that if your order has already been partially filled, only the remainder of the order will be cancelled. It is not possible to reverse any filled portions of active orders.

Where can I see my Order History?

To checking your order simply on the Order HistoryOn Desktop

1. From the Dashboard, by clicking on the Exchange tab on the top column to purchase or sell crypto.

2. Then, scroll down and click on the Order History tab to view your full market and limit order history. You can also see your cancelled orders by selecting the Show Cancelled toggle.

On the Coinmetro Mobile app

From your Dashboard, you can enter the Exchange Platform by either tapping on the ’Buy/Sell’ icon below your account balance, or tapping on the ’More’ icon in the bottom right-hand corner, then clicking on ’Exchange’.

Then, scroll down and click on the ’Order History’ tab to view your full market and limit order history.

What is an Order Book?

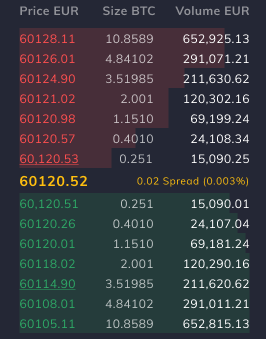

An order book on the Exchange Platform is simply a list of buy and sell orders placed by market makers for a specific trading pair such as BTC/EUR or ETH/USD.

Below is an example of the BTC/EUR order book.

As we can see in the image above, the order book is split into two sections:

-

Bids (buyers) in green

-

Asks (sellers) in red.

In the middle of these highlighted in yellow, we can see the “mid-price”. This is simply just the price in the middle of the lowest ask and highest bid.

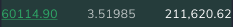

Anyone can be a “market maker” by simply placing a Limit Order. Whilst your limit order is active, this will appear in the order book underlined. In the example below, we have placed a bid (buy) for BTC at 60,115.00 EUR.

As you can see, your active order will appear on the green side as it is bid, and you are saying you want to buy BTC for this specified price. Essentially, your order is placed in a queue until it is filled by another trader, or if you decide to cancel it.

Spread

When we are referring to the spread of an order book, this can easily be described as the difference in price between the lowest ask and highest bid. The spread can be displayed as an absolute value which is €0.02, or as a % value which is 0.003% as shown in the example below.

Whilst it is common to see either one of the other, Coinmetro displays both for transparency.

Cumulative Orders

Coinmetro allows users to control how they visualize the order book in multiple ways.

Firstly, you are able to view all the orders in the book cumulatively. This means that instead of seeing multiple levels and the amount at each price level independently, you can see the sum as you look up the book. This can be achieved by selecting the symbol as shown below.

This feature is extremely useful in the case you are placing a market order and the order book is fairly thin/illiquid. You will be able to see exactly how your buy or sell order will impact the price of the asset you are trading, which can help you determine if you wish to wait/place a smaller or larger order, or use another order type such as a limit order.

Cumulative Volume

Cumulative volume essentially works the same as the cumulative order book; but instead of showing the values cumulatively, it only shows the volume bars (the red and green bars in the book). This can be achieved by selecting the symbol shown below.

This feature can be very useful at a glance to see where there are larger orders or ’holes’ in the order book.

Maker Fees vs Taker Fees

When placing an order on the Coinmetro Exchange Platform, you would either incur a taker or maker fee. So, what is the difference between the two?

Taker Orders

Clients who place an order that is filled immediately, such as a market order will be charged a taker fee. These orders take liquidity from the order book, and as such are called takers. Takers on the Coinmetro Exchange will pay a commission of 0.10%.

Maker Orders

A maker order is a limit order which rests in the order book for any period of time. This terminology comes from the fact that placing limit orders on the books helps to “make the market,” which makes you a “market maker”.

Makers pay no commission on the Exchange Platform, and the maker fee is 0%. For Margin trades, you will be charged 0.1% fee for the initial and subsequent trade (in and out of the trade), equalling 0.2% total.

Earn XCM from Trading

Staking your XCM at Coinmetro enables traders to earn XCM rebates from their trading fees, among other benefits. Up to 25% of taker fees can be paid back in XCM, and makers can earn up to 50% of the taker’s net fees.

The XCM Token Utility

100% of all the trading fees will be used to purchase XCM directly from the market, and up to 50% will be time vaulted and taken out of the supply. As the trading volume increases, so will automated market buying.